Forex Trading Articles

USING RISK AND REWARD IN TRADE MANAGEMENT

By Dick Thompson for Forexmentor

©2009, Forexmentor.com, June, 2009

As traders we strive to develop a methodology such that over a large number of trades we can depend on our edge to move the probabilities in our favor and expect to win the game. But, on any given trade, we do not know whether it will win or lose. Each trade is unique and in the marketplace, anything can, and will, happen. Thus, some trades will move smartly in a direction towards our profit target while another trade might move towards our stop. Which scenario will occur for a given trade is unknown.

Nor is there is there any way of knowing what the final outcome will be while either scenario is in progress. But we do know that how we behave during that time, is critical to our trade’s success. That behavior is called trade management. For instance, we have all observed a trade approach a profit target and stall just before it gets there. Among the various things we can do at this point are: close the trade and take most of our profit, or hold on for the last few pips? A tricky decision to make. The rules of our trade management should be precise enough to allow this decision to be made without emotion or indecision. Or perhaps a trade moves towards our stop shortly after entry. Now we have another discussion: accept the inevitable and close the trade before it reaches the stop, saving a few pips, or hold on, hoping that it will reverse in our direction. Again, an agonizing decision. And again, we should be able to rely on the rules of our trade management to help us.

Without a rigorous set of rules, we might waffle in our decision. We might watch price move and set mental levels for various decisions. And then watch those levels come and go and set new levels as our decision making process is taken over by emotion rather than rational thought. There should be a better way.

Interesting enough, even though these scenarios are very similar in that they are both possible and not unexpected outcomes of placing a trade, our response to them is generally not similar. Our behavior to that trade that moves close to our target and then hesitates is to hold out for those last few pips. But our response to that trade that moves close to our stop is to close the trade and save those last few pips. Diametrically opposite solutions to similar problems.

Most trade planning includes consideration of risk versus reward. Knowing that the laws of probability will cause some percentage of our trades to fail, even with the best of strategies and the best of executions, we want the potential reward to be at least equal to the risk. This is not something that we can do precisely of course, because even though we can control our risk (one of the few things we can control) we cannot control the reward. So, we tend to look for trades that have a potential reward that gives us a reward to risk ratio of two or perhaps three. This is good planning and is fairly standard practice. But once planning is over and we have entered the trade, we tend to forget risk/reward considerations, don’t we. That is wrong because the logic is sound as a means of decision making in more than trade planning. For instance, it can be a tremendous help in consideration of the scenarios we have discussed above.

Lets revisit the case above where a trade approaches a profit target and stalls just before it gets there. In order to quantify our thinking, lets assume that our original trade was made with a profit target of 75 PIPs and a stop of 25 PIPs; a reward to risk ratio of 3:1. But now, for example, price has bogged down 15 PIPs short of our target. If we think of that last 15 PIPs as “reward”, and compare it to the current risk which is 85 PIPs, we now have a reward to risk ratio of 0.18. So how does the current R/R ratio of 0.18 compare to the original R/R ration of 3.0? Not well, I should think. So, can you see that a decision to hold out for those last 15 PIPs at this point is a very high risk proposition when you compare the potential gain to the potential risk? If your trading plan requires you to use a ratio of 3:1 to initiate a trade, should you be making a decision to try for those last few PIPs when the ratio is now negative? Probably not.

Note: I calculated the current risk as the 60 PIPs already gained plus the 25 PIPs of original risk.

If your trade management plan requires you to move your stop to break even or some other action, you might adjust this number accordingly.

Consider the second scenario above in the same fashion, with the same numbers. In this case, price drops towards our stop of 25 PIPs shortly after entry; for example 20 PIPs. Now our risk can be considered 5 PIPs. What is our reward? It is the 20 PIPs plus the 75 PIPs of profit that potential exists before we would exit, or a reward to risk ration of 19.0. WOW! That is much better that our trading plan requires. Why would we not stay in this trade at this point?

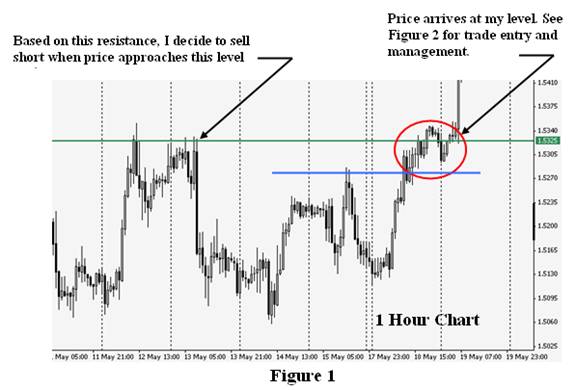

Lets examine a recent, real life example. Consider the GBPUSD setup in Figure 1 below. I planned to sell if price retested the highs of the previous week, 1.5325. It was late in the day, price had exceeded the Average Daily Range and I thought the probability of a decent bounce was good. I would take first profit before the recent support level of 1.5286 (Blue Line) for a target of 39 PIPs. I plan a 29 PIP stop (includes spread of 4 PIPs); not a great R/R ratio, but sufficient since I will leave part of the trade with stop moved to BE after first profit.

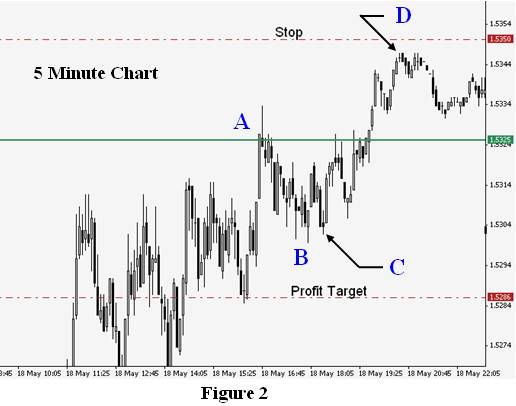

Figure 2 shows a 5 minute chart of the trade. I entered short at 1.5325 (Point A). The traded gained 26 PIPs (Point B) and then retraced quickly. We should be paying attention now. When price moves down again, this time to 1.5297 (Point C), for a profit of 28 PIPs, we should be thinking about Risk vs. Reward. At this level, our reward is 28 PIPs; but our risk, based on our stop, is the 28 gain plus 29 to the stop, or 57 PIPs, over 2:1 negative. What should we do?

Lets assume that we do nothing. Now, sometime later, we find price has moved back to our entry and beyond, giving us a loss but still not yet to our stop. We are now at Point D. Our loss is 22 PIPs so far. Our potential reward from here is the gain that we gave back of 28 plus the loss so far of 22 or 50 PIPs. And our possible risk from here to our stop is only 7 PIPs. Wow! That is a reward to risk ratio of about 7. What should we do now?

In the above discussion I have described a way of looking at two issues that we encounter frequently in our trade management and how a consideration of Risk and Reward Ratios can help us make more sound decisions. The numbers I have chosen to quantify my examples should be adjusted according to the particular rules by which you trade. However, the conclusions should be similar. The point is that using a logical method of analysis to make our decisions quite often will give us much better answers than using no method at all, which leaves us vulnerable to emotions. Oh, and in the example, what would you have done?

Index of All Forex Trading Articles

|

|