Forex Trading Articles

USING LEVERAGE IN FOREX TRADING

(Part II)

By Dick Thompson for Forexmentor.com

©2007, Currex Investment Services Inc.

February 3, 2007

In Part I of this series, I discussed the concept of leverage and described how a lack of understanding can lead to poor trading decisions. In this article, I will expand on that theme and explain Margin, how it relates to leverage and how it is used.

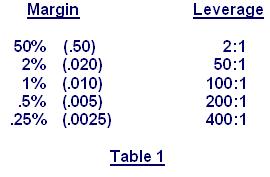

Lets start by defining Margin. Margin is nothing more than the collateral that the broker requires you to maintain in your account before he will lend you money to trade. If for example, he specifies that he requires a 50% Margin - he is telling you that you must maintain at least half of the value of your trades in your account and he will then loan you the other half. If you have a $5,000 account balance, you can have up to $10,000 in trades. This 50% Margin is the same as a Leverage of 2:1 and in fact, there is a very specific relationship between Margin and Leverage as they are reciprocals.

Your broker establishes the Margin that he will require of you in your trading. By definition (the meaning of reciprocal), he has also established Leverage. While Leverage may vary from broker to broker, it is common practice for the broker to offer 100:1, 200:1 or 400:1 on a Mini account or Standard account. It is important to note that these Leverages and those in Table 1 are the Leverages that are offered by the broker as the maximum borrowing power available, but generally NOT the leverage that you trade with (for clarification of this concept, please read Part I of this article).

Another, more useful way of specifying Margin, is Margin per Lot, based on the value of each lot in your trading. As you know, in a Mini account, each Lot controls $10,000. In a Standard account, each Lot controls $100,000. Margin per Lot can be defined as the Value of the Lot times the Margin, expressed as a decimal. For instance, if you are trading a Mini account with a lot size of $10,000 and your Margin is .25% (Leverage = 400:1) the Margin per Lot will be $25 per Lot.

$10,000 x .0025 = $25.00 per lot

Let’s go through a specific scenario in detail to see how these concepts apply:

Assume that your Mini account has a balance of $6,000 and is setup with a Margin of .25% (Leverage of 400:1). Thus, from our equation above, your broker will margin your account at $25 per lot. Assume now that you place a 10 lot trade. Trading 10 mini lots means that you are controlling 10 x $10,000, or $100,000 and that is the value of your transaction. You should also be aware that even though you are permitted a leverage of 400:1, you are only leveraging this trade at 16.67:1.

10 lots x $10,000 / $6,000 = 16.67

With 10 lots and a margin of $25 per lot, your total margin, or the collateral required by your broker for the trade is $250. With your total equity of $6,000 in your account, there is no problem maintaining this amount.

Now consider this trade going against you in a significant way. How much of a draw down can you tolerate with the circumstances given? The answer is that you can tolerate a draw down of your available equity from $6,000 to $250, or $5,750. At this point, the broker will close your trade leaving you with only $250 of equity in your account. More specifically, with 10 lots in the trade, your currency pair can drop 575 pips before we are closed out (remember that a pip is worth $1 in a Mini account).

10 lots x $1 per pip x 575 pips = $5,750

Clearly, this is a large drop and shows that your account has quite a lot of protection against being wiped out. Such is the advantage of trading with a modest amount of leverage, even though much higher leverage is available. By comparison, consider the following trade:

Assume this time that you are trading a standard account with a balance of $6,000. Standard accounts normally have Margin of 1% (Leverage of 100:1) and each Lot controls $100,000. Thus, from our equation above, your broker will margin your account at $1,000 per lot ($100,000 X .01). Given your account size of only $6,000 and the need to maintain $1,000 of Margin in the account, you will be limited to a trade of only 5 Lots. Since a trade of 5 Lots would have no tolerance for draw-down before exceeding the Margin requirement, lets assume that you trade 4 Lots. As before, you are controlling 4 $100,000 Lots for a transaction of $400,000.

With 4 lots and a margin of $1,000 per lot, your total margin, or the collateral required by your broker for the trade is $4,000. With your total equity of $6,000 in our account, this trade might not be as comfortable as the example above.

Now consider this trade going against you. How much of a draw down can you tolerate with the circumstances given? The answer is that you can tolerate a draw down of your equity from $6,000 to $4,000, or $2,000. At this point, the broker will close your trade leaving you with $4,000 of equity in your account. More specifically, with 4 lots in the trade, your currency pair can drop 50 pips before we are closed out (remember that a pip is worth $10 in a Standard account).

4 x $10 x 50 pips = $2,000

Which trade would you rather be in? By the way, the leverage of this trade is the total value of the transaction, $400,000 divided by the value of your account, $6,000 or 66.67:1.

These two examples use practices that are typical of the broker that I am familiar with. There clearly are many brokers and many differences between brokers. For instance, one broker agreement that I have read states that they will allow the available margin to go to zero before closing all trades (a Margin Call) in an account. Another broker states that they will close all trades when available margin reaches the current allowable margin based on open trades at that time. In almost all cases, the brokers reserve the right to use their discretion and will act in their own best interests. When they execute a Margin Call, they will close all trades in your account, usually without notification. Given these facts, it is imperative that each of us knows and understands what our broker might do regarding margin in our accounts.

Index of Other Forex Trading Articles

"I feel totally empowered and humble all at the same time. If everyone learned from you guys, it might get a lot more difficult to make money in the Forex. Last week, using Chris's basic guidance I captured 300+ pips"

- Darryl Warren - Lompoc, CA

FOREXMENTOR PRO TRADER ADVANCED FX COURSE

Full Content Summary

|

|