Forex Trading Articles

DOES IT MAKE SENSE?

By Dick Thompson for Forexmentor

©2013, Forexmentor.com, February 2013

As a technical trader, I find it challenging to apply my trading methodology in an external environment that is complex, requires a completely different skill set to understand, and is generally of little interest to me. I am referring to the economic fundamentals that surround us in the world that so often seem like a rapidly moving target, shrouded in ambiguity and seen through a heavy fog. Given that "The markets can remain irrational longer that you can remainsolvent" as was supposedly stated by John Maynard Keynes, one of the most influential economists of the 2oth century, we as traders are faced constantly with the challenge of understanding what we see on our charts. Can we identify the "irrational exuberance" that then Federal Reserve Board Chairman Alan Greenspan noted in a speech give in the 1990's? If we can't we are unlikely to remain solvent.

There are various ways that traders approach this challenge; ignore it, pay our money and take our chances; become an expert in understanding the fundamentals, perhaps by trading only one currency pair; or, as I have, try to deal with it using common sense.

I want to emphasize that the market must make sense "to me". Everyone sees the market somewhat differently. If you are a pattern trader, you will trade some patterns but not others. Why? Probably because some patterns you see easily, others just don't make sense to you. So you don't trade them. If you are a trend trader, you determine the direction of the trend in a certain way, with specific indicators and on a specific time frame or frames. The same for the strength of the trend. Others may do it differently and get a different result. What about breakout trading? Some people swear by them; others swear at them. Trading is one area where it is important to belong to the "me" generation.

Suppose you are a trend trader and you rely on support and resistance to trade. How would you feel about a chart like this?

Lots of areas where support becomes resistance. Price action is making sense. There is no reason not to trade if there is a setup that meets the criteria of your trading method.

But how about this one?

Not so much, right? Is there clearly defined support or resistance in this strong trend. Is this price movement what you expect in an orderly market? Does this market make sense to you? Sufficient to trade it?

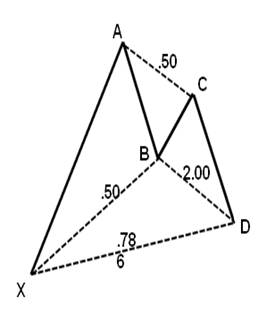

Perhaps you are a pattern trader. You favor the Gartley. I introduced the Gartley pattern in Part IV of the January 2007 article “Using Fibonacci Ratios for Forex Trading”. In that article, I presented the following Figure:

The Gartley Pattern The Gartley Pattern

As I stated, the importance of this pattern in trading is that the probability of point D being a reversal point is supported by the fact that all swings are Fibonacci retracements or extensions.

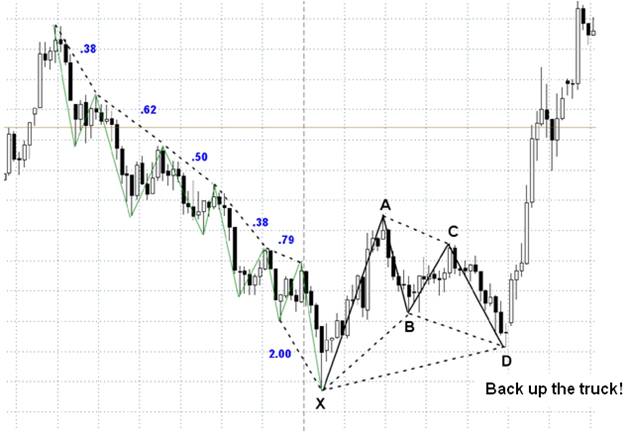

Below is a 15 min chart on the USDJPY from early February, 2013. A beautiful bullish Gartley sets up after a series of swings down. Take a close look at each of those swings as price falls Each one contains a retracement that is almost a perfect Fibonacci ratio. And the last swing is an almost perfect 2.00 extension. Is this market making sense? Would you take this pattern trade? How would you have felt if that move down had no swings, or the swings ratios had no relationship to Fibonacci values? The trade still could have worked, but would you have considered it a high probability trade? Would you have backed up the truck?

I hope the discussion and the examples give you the idea of how I try to apply common sense to the market by way of price action and movement. My trading depends on certain technical parameters that are best confirmed when the market makes sense to me. This gives me the highest probability that the trade will work. Good luck, good trading.

Index of All Forex Trading Articles

|